indiana real estate taxes

Tax amount varies by county. Provides that for each calendar year beginning after December 31 2021 an annual adjustment of the assessed value of certain real property must not exceed the lesser of.

See Property Records Tax Titles Owner Info More.

. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. A propertys assessed value is the basis for property taxes. Dial these numbers in case of any emergency.

Statements are mailed one time with a Spring A coupon and Fall B coupon. If you have an account or would like to create one or if you would like to pay with Google Pay PayPal or PayPalCredit Click Here. Criminal Justice Institute.

It is one of 38 states in the country that does not levy a tax on estates. Make and view Tax Payments get current Balance Due. This is around half the national average.

Indiana hasnt released the amount at the time of this writing but the current amount is either 60 of your propertys assessed value or a maximum of 45000 whichever is less. The information provided in these databases is public record and available through public information requests. Counties in Indiana collect an average of 085 of a propertys assesed fair market value as property tax per year.

Enter an Address to Begin. Ad Property Taxes Info. Apart from the county and its cities different specific-purpose units among which are college districts.

View Ownership Information including Property Deductions and Transfer History. Use this application to. Our staff is equally devoted to achieving our goal of fair and equitable assessments.

Homeland Security Department of. Mass appraisal is not perfect so we encourage the individual taxpayer to review. Ad 4 Simple Steps to Settle Your Debt.

It typically accounts for the largest segment of the general revenue fund in these municipalities. There is a federal estate tax that may apply. View and print Tax Statements and Comparison Reports.

For best search results enter a. Tips for Your Job. The amount youll pay in property taxes varies depending on where you live and how much your home is worth but the.

Indiana communities rely on the real estate tax to fund governmental services. Corrections Indiana Department of. Search Any Address 2.

In Indiana the average property tax bill is only 1163 per year. Taxes in Indiana are due annually in 2 installments due in May and November. Pay Your Property Taxes.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. A property tax in each state is calculated using an average effective property tax rate of. To receive the homestead deduction you must file an application with your Countys.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. Indiana capps property tax rates at 1 of the value for residential property 2 of the value for rental property and farmland and 3. Visit the Clark County Property Tax Assessment Website.

The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about. Law Enforcement Academy Indiana. The average national rate is around 48.

The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate. Indiana has relatively low property taxes. Tax deadline for 2020 realpersonal taxes.

The statewide average revenue distribution for each property tax dollar is as follows. National Guard Indiana. These taxes may include.

View and print Assessed. You will receive your statement in the mail towards the end of March. Be Your Own Property Detective.

County-City Building 227 West Jefferson Blvd Suite 722 South Bend IN 46601. Create a Website Account - Manage notification subscriptions. If you no longer.

2019 pay 2020 property taxes are due May 11 2020 and November 10 2020. 1 an amount equal to the percentage change in the consumer price. The median property tax in Indiana is 105100 per year for a home worth the median value of 12310000.

Property taxes in Indiana are paid in arrears meaning the taxes paid in the current year represent the taxes owed for the previous year. A homeowner with a median Indiana home value of 144600 will pay 1436 0993 annually in Hamilton County versus 753 0521 in Orange County. There is no estate tax in Indiana.

A Full Online Property Taxes Search Only Takes Two Minutes. Search For Title Tax Pre-Foreclosure Info Today. Please direct all questions and form requests to the above agency.

Jobs Marketplace. Estate income tax through the. State Excise Police Indiana.

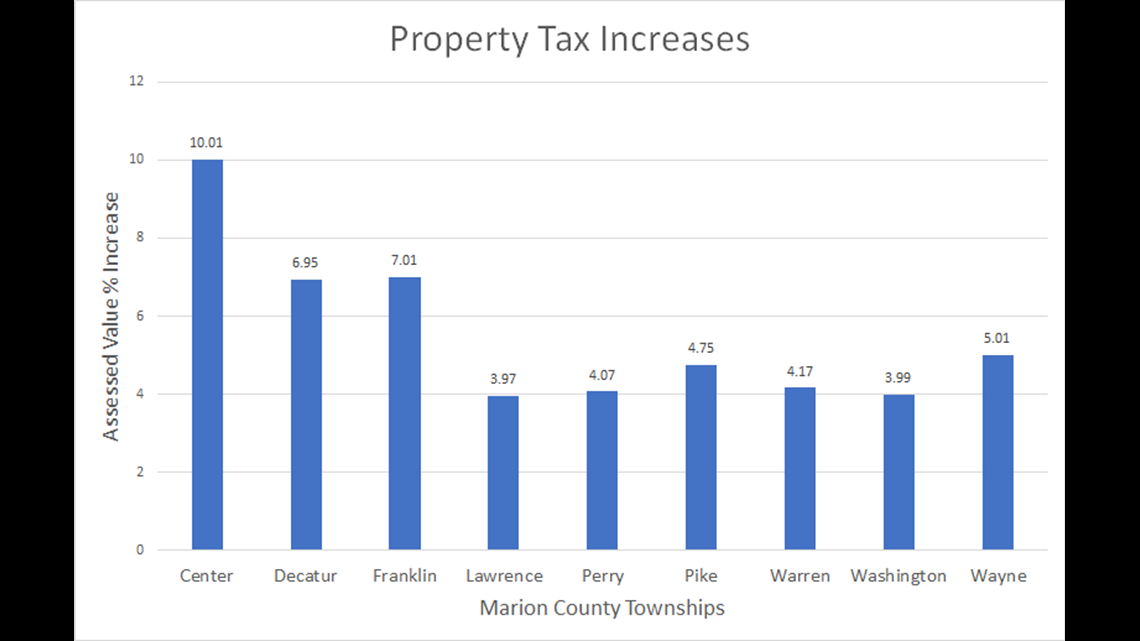

Property tax increase limits. Property Taxes Due Fall Property Taxes are due November 10 2022 Read On. What Other Taxes Must be Paid.

Please direct all questions and form requests to the above agency. Property Reports and Tax Payments. Property taxes are an ad valorem tax meaning that they are allocated to each taxpayer proportionately according to the value of the taxpayers property.

In fact the average annual property tax paid in Indiana is just 1263. Indiana Gateway Local Tax Finance Dashboard QuickLinksaspx. The states effective property tax rate is 11 while the national average is 107.

Indiana Career Connect. The final income tax return of the decedent.

Stacy Johnson Indiana Home Living What Are Closing Costs All Settlement Or Transaction Charges That Home Buyers Need To Pay At The Close Of Escrow When The Property Is Transferred

How Will Proposed Annexation Affect Monroe Co Property Taxes County Unveils New Tax Calculator News Indiana Public Media

Property Tax Calculator Smartasset

Current Payment Status Lake County Il

Indiana Property Tax Deductions Are You Getting All Yours The Derrick Team 317 563 1110

Property Tax Calculator Smartasset

Why You Ll Likely Pay More In Property Taxes This Year Wthr Com

State Lawmakers Eye Business Tax Cuts Indianapolis Business Journal

How We Got Here From There A Chronology Of Indiana Property Tax Laws

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

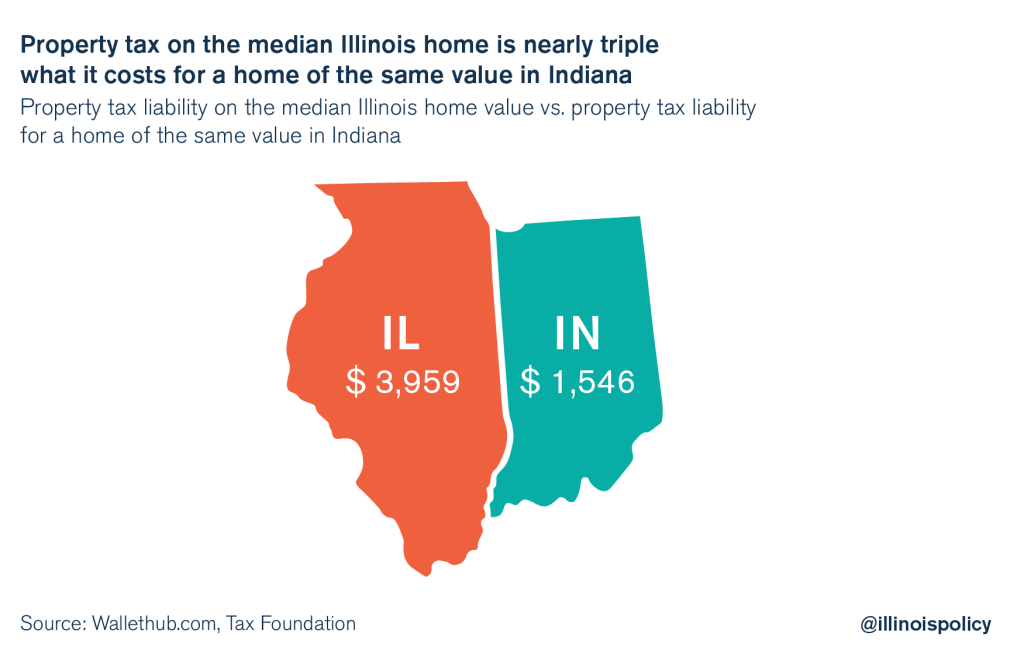

Illinois Has Higher Property Taxes Than Every State With No Income Tax

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Property Taxes How Much Are They In Different States Across The Us

Treasurer Johnson County Indiana

Indiana Real Estate Continuing Education Real Estate Taxes

Pennsylvania Property Tax H R Block

Ranking Property Taxes By State Property Tax Ranking Tax Foundation