sacramento property tax rate 2021

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax. Sacramento property tax rate 2021.

San Francisco Bay Fed By The Waters Of The Sacramento San Joaquin Download Scientific Diagram

1-916-274-3350 FAX 1-916-285-0134 wwwboecagov December 31 2020.

. 450 N STREET SACRAMENTO CALIFORNIA. Ad View Your Homes Appraisal Value Suggested Listing Price - Fast and Free. Tax Collection Specialists are available for customer assistance via telephone at 916 874-6622 Monday Friday from 900am to 400pm or via email at TaxSecuredsaccountygov.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Tax Collection and Licensing. The minimum combined 2022 sales tax rate for Sacramento California is.

Sacramento County Finance. View the E-Prop-Tax page for more information. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

Voter Approved Bond Debt Rates. Online access to all tax records and real property records. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143.

Tax Collection and Licensing. 2021-22 Sacramento County Property Assessment Roll Tops 199 Billion. Sacramento Property Tax Rate 2021.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. That means that while property tax rates in Fresno County are similar to those in the rest of the state property taxes paid.

Fiscal Year 2015-2016. This years roll growth will yield an additional 97 million in revenue over last year. Tax rates are provided by Avalara and updated monthly.

The assessment roll is the total gross assessed value of locally assessed real business and personal property in Sacramento County. The median property tax on a 32420000 house is 220456 in Sacramento County. When calling the Tax Collectors Office your call is answered by our automated information system.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties. Ad Find County Online Property Taxes Info From 2022.

On the commercial side the median rate in 2021 was 1739 down from. They can be reached Monday - Thursday 830 am. Property tax revenue funds over 175 local government agencies including schools special districts such as fire park and community service districts as well.

PROPERTY TAX DEPARTMENT. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Available 24 Hours a day 7 days a week 916 874-6622.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. Skip to main content. Find All The Record Information You Need Here.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. The 2021-22 assessment roll will generate approximately 19 billion in property tax revenue.

Automated Secured Property Information Telephone Line. Additional exemptions might be available for farmland green space veterans or others. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee. Look up 2022 sales tax rates for Sacramento California and surrounding areas.

Browse Current and Historical Documents Including County Property Assessments Taxes. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. Property Tax Administrative Fees - SB 2557.

Thursday July 15 2021. Permits and Taxes facilitates the collection of this fee. PO BOX 942879 SACRAMENTO CALIFORNIA 94279-0064.

Sacramento Property Tax Rates. Unsecured property tax bills are mailed to all owners of unsecured property in July of each year. Payments may be made by mail or in person at the county tax collectors office located at 700 h street room 1710 sacramento ca 95814 between the hours of 8 am.

All are public governing bodies managed by elected or appointed officers. The property tax rate in the county is 078. Unsure Of The Value Of Your Property.

2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171. View the E-Prop-Tax page for more information. The County sales tax rate is 025.

The median home value in Fresno County is 237500. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The sacramento sales tax rate is.

Annual bills for Sacramento County unsecured personal property taxes for fiscal year 2021-2022 will be mailed on July 16 2021 and are payable without delinquent penalties through Aug. A delinquency penalty will be charged at the close of the delinquency date. Ad Learn about all your personal and commercial value for taxation.

2021-22 CALIFORNIA CONSUMER PRICE INDEX Revenue and Taxation Code section 51 provides that base year values determined under. Tax management for vacation rental property owners and managers. This tax has existed since 1978.

Please make your Property tax payment by the due date as stated on the tax bill.

How To Hire In Sacramento Sacramento Ca Hiring Trends For 2022

City Of Sacramento Adu Regulations And Requirements Symbium

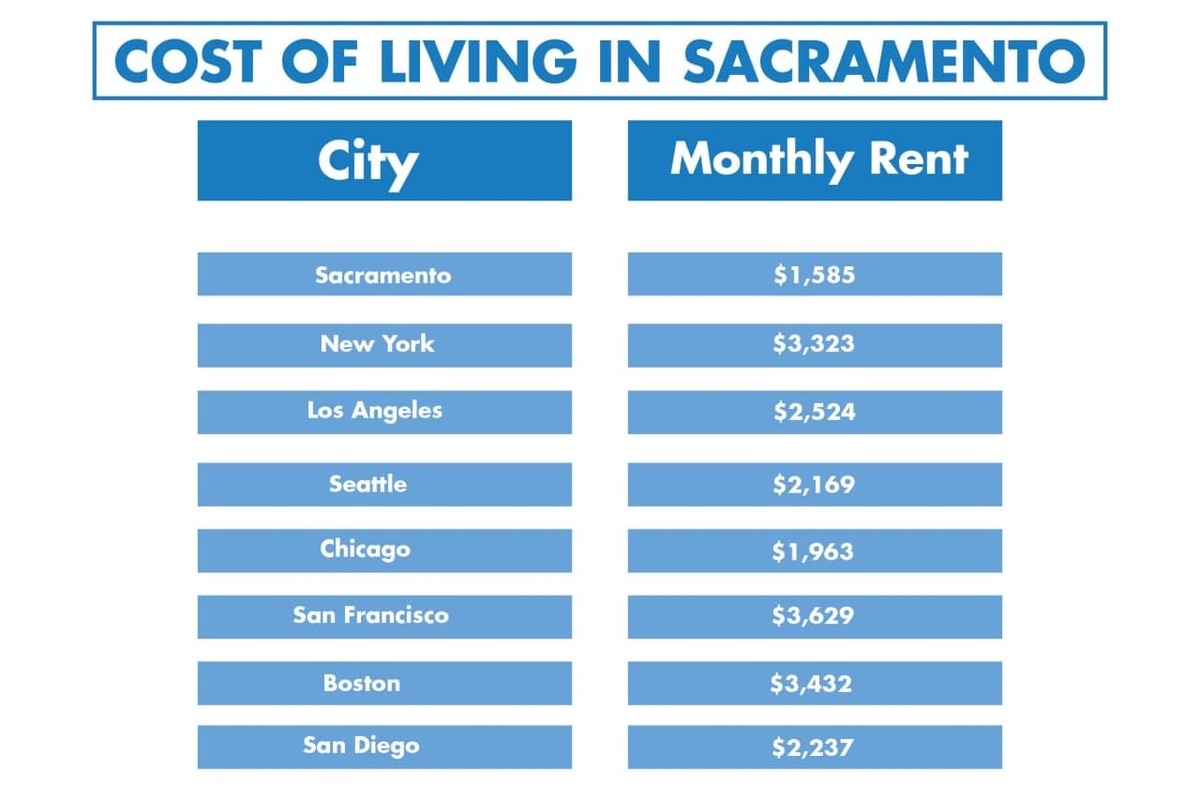

Moving To Sacramento 2021 Relocation Guide 10 Tips For A Smooth Relocation

Calfresh Sacramento 2022 Guide California Food Stamps Help

Real Estate Heading In The Right Direction Home Ownership Real Estate Fort Lauderdale Real Estate

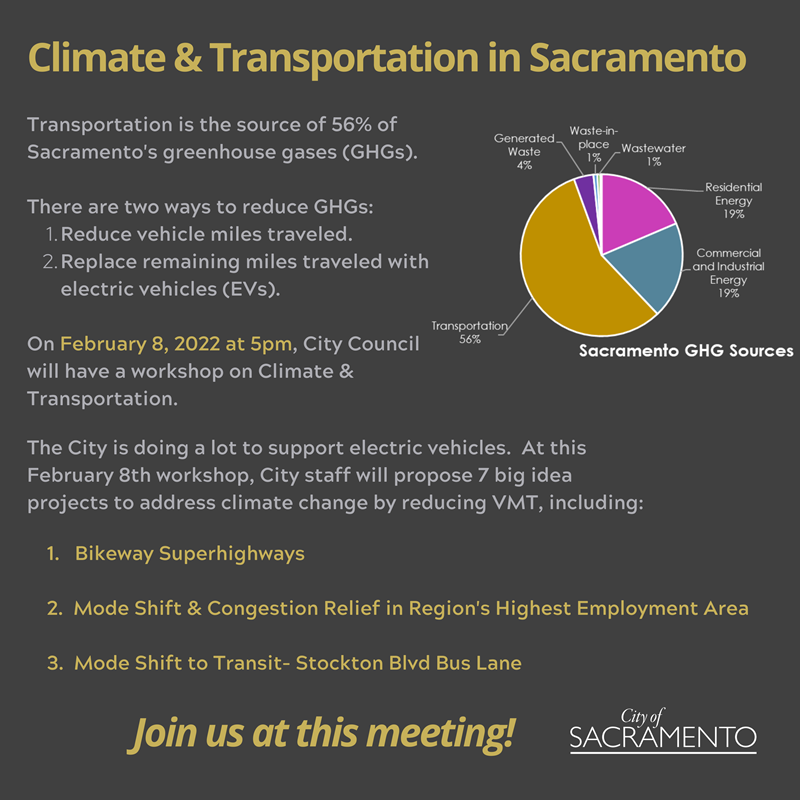

Climate And Transportation City Of Sacramento

Calfresh Sacramento 2022 Guide California Food Stamps Help

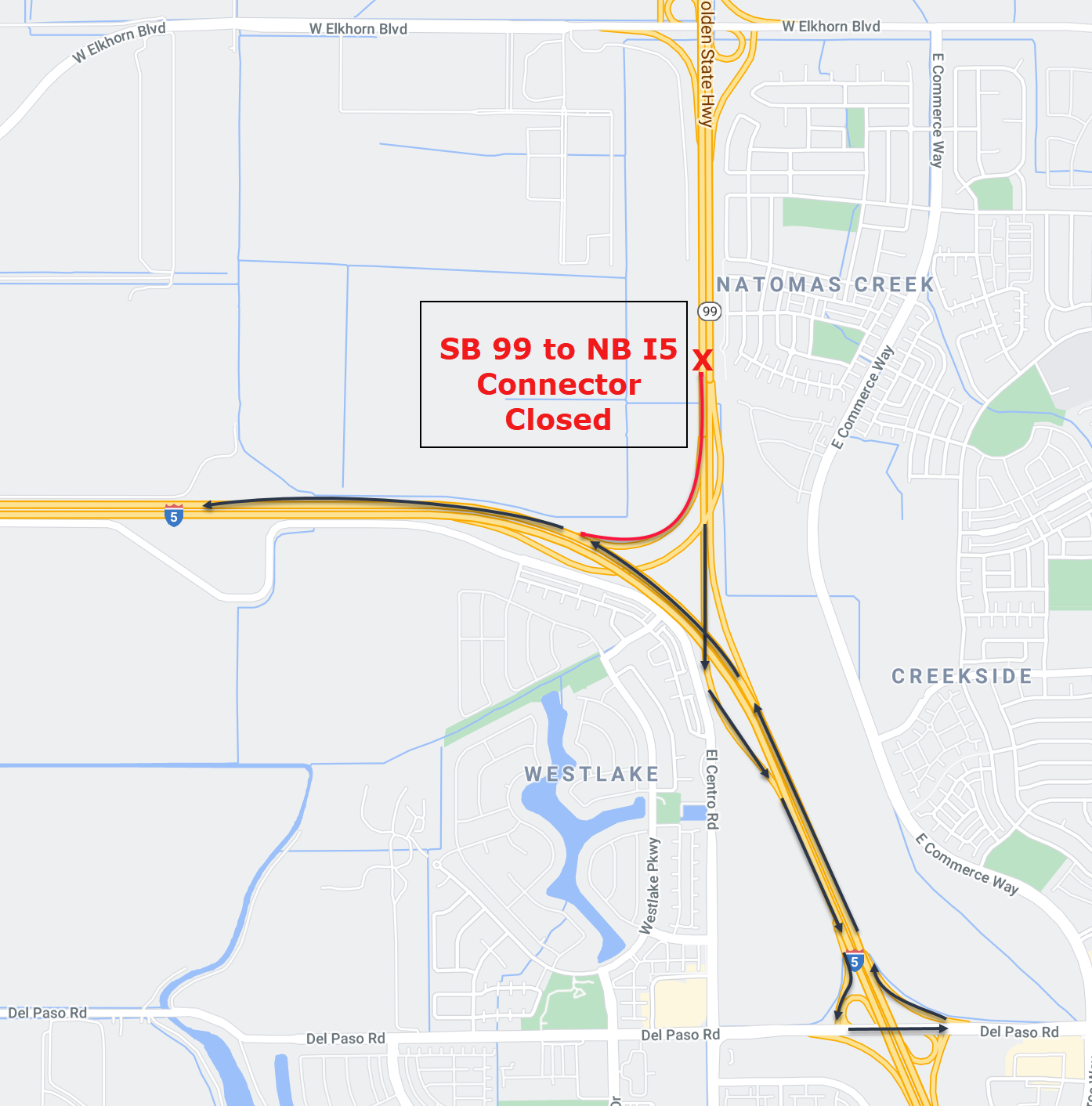

I 5 Metro Air Parkway Interchange

2022 Best Sacramento Area Suburbs To Live Niche

![]()

Community Development City Of Sacramento

Sacramento County Ca Property Tax Search And Records Propertyshark

Map Of City Limits City Of Sacramento

November Home Prices Rose 9 5 One Of The Highest Gains On Record Case Shiller Says Moving To Idaho House Prices Sacramento County

Affordable Rental Housing City Of West Sacramento

Services Rates City Of Sacramento

Sacramento Valley Struggles To Survive Record Water Cuts Calmatters